Markets seem confused as to whether demand is now solid and deflation fears a thing of the past, or if it is just about to come back with a vengeance. We’ve had solid job growth (inflation!), tanking oil prices (deflation!), Swiss National Bank refusal to follow Euro devaluation (deflation!), ECB quantitative easing (inflation in Europe? deflation in America?). One place we can look to see how Fed money printing is filtering into the credit structure is in the collective balance sheets of America’s four largest banks (JP Morgan Chase, Bank of America, Citigroup & Wells Fargo).

As we can see from the chart below, total assets and liabilities have been growing in lockstep. Assets of these four banks now total $8.17 trillion while liabilities are at $7.31 trillion.

What about credit creation? Banks balance sheets are maintaining their equity, but they have been collecting massive amounts of deposits ($3.59 trillion to $4.52 trillion in 5 years) while loans have remained flat ($3.00 trillion to $3.17 trillion).

Before you blame the banks, remember that it takes two sides to make a loan happen. American consumers have been saving more, using credit less. This preference for cash is showing up in the graph above. So instead of more credit from the base level of deposits, banks are stashing this extra cash elsewhere. But where?

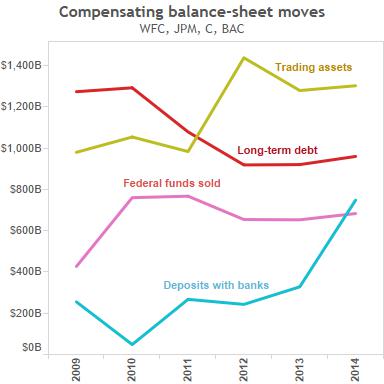

Below we see the major changes in assets and liabilities of the four largest American banks. The extra deposits appear to be flowing in a way as to 1) increase assets like deposits with banks, trading assets and (early on) federal funds sold and to 2) reduce long-term debt.

These are not the balance sheet trends of a credit boom by any means. Banks and consumers are still too fearful to shift money into credit, keeping monetary conditions tight even with a larger Federal Reserve balance sheet. But with deposits rising so quickly, it almost feels like the gun is being cocked. If some event takes place to suddenly increase our inflation expectations, credit could explode quite suddenly. The question is whether the economy has enough slack to accept it.

Leave a Reply